Automatisation marketing pour agences et cabinets d’assurance

Automatisez, engagez et changez d’échelle avec des solutions marketing intelligentes pour l’assurance

Réserver une démoL’automatisation marketing intelligente de PathwayPort pour les agences et cabinets d’assurance améliore l’efficacité en rationalisant les opérations, en personnalisant l’engagement client et en stimulant la croissance et la rétention des polices. Dans un secteur compétitif où les processus manuels freinent les progrès, l’automatisation transforme la gestion des polices, des relances et des renouvellements — libérant du temps tout en assurant une communication fluide et de meilleurs taux de rétention. Intégrée aux principales plateformes BMS/AMS, PathwayPort favorise la croissance et rehausse l’expérience client.

Principaux avantages de l’automatisation marketing pour l’assurance :

-

Éliminer les tâches manuelles

Économiser jusqu’à 80 % du temps administratif

-

Rationaliser renouvellements et rappels

Renouvellements de polices et notifications de facturation automatisés

-

Campagnes personnalisées

Engager les clients via des communications ciblées

-

Meilleures conversions et rétention

Accroître les conversions et fidéliser les assurés

-

Upsell et ventes croisées ciblés

Stimuler la croissance en proposant des polices additionnelles pertinentes

14 workflows incontournables d’automatisation marketing pour l’assurance

Vous souhaitez rationaliser les opérations de votre agence et accélérer la croissance ? Découvrez 14 workflows automatisés essentiels utilisés par les meilleures agences et cabinets pour améliorer la communication client, automatiser les processus clés et augmenter les revenus.

-

Renouvellement des Flux de travail

Automatiser les rappels de renouvellement de polices.

-

Preuve d'Assurance

Envoyer instantanément les attestations de couverture.

-

Rappels de facturation

Assurer des paiements ponctuels et réduire les impayés.

-

Campagne de bienvenue

Accueillir automatiquement les nouveaux clients.

-

Série de Suivi des Devis

Assurer efficacement le suivi des devis d’assurance.

-

Série de perspectives

Nourrir les leads jusqu’à la souscription.

-

Campagne de vente croisée

Promouvoir des polices additionnelles.

-

Campagne « Parraine un ami »

Encourager les clients à recommander votre agence.

-

Campagne de révision en ligne

Obtenir des témoignages et renforcer la crédibilité.

-

Courriel d'anniversaire

Personnaliser la relation client.

-

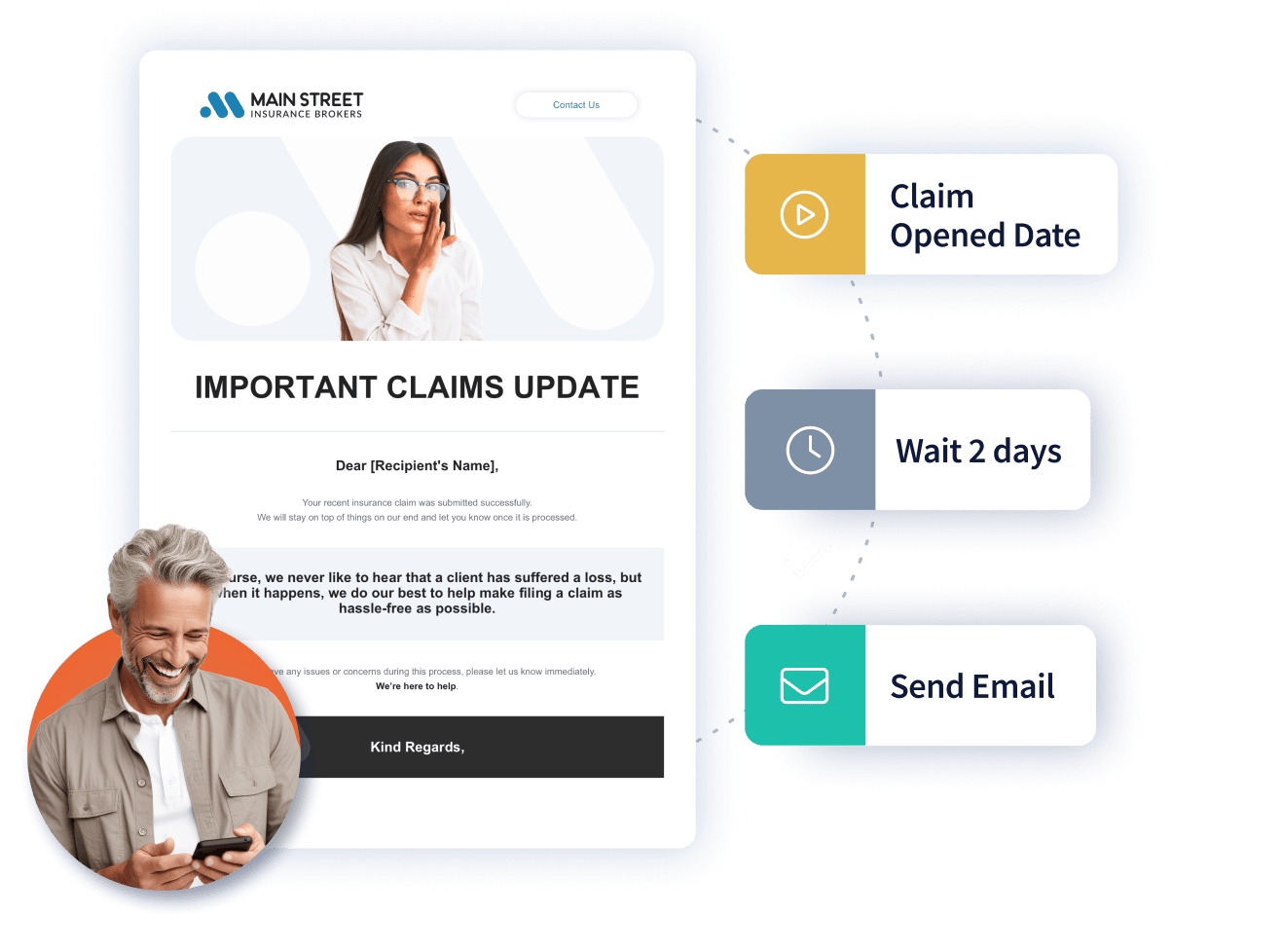

Série de réclamations

Guider les clients de manière fluide lors des sinistres.

-

Sondages NPS® par Courriel

Mesurer la satisfaction client.

-

Clients perdus

Réengager les clients inactifs ou perdus.

-

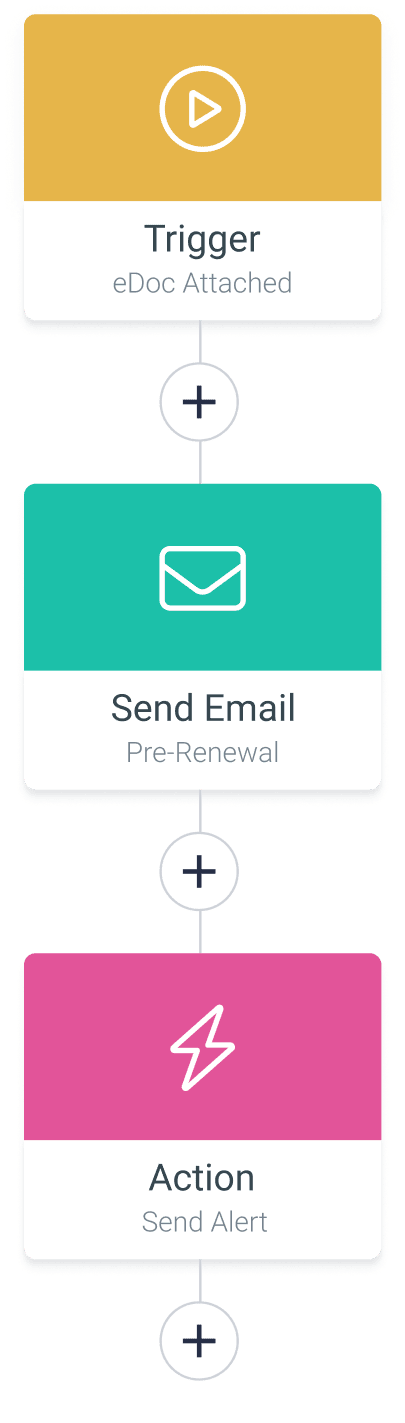

Livraison électronique de documents — module optionnel

Distribution de documents sécurisée et sans papier.

Free Ebook

Construisez une agence d’assurance plus intelligente

Votre guide complet pour lancer, scaler et automatiser votre agence avec les bons outils et la bonne stratégie.

- Apprenez à bâtir un business plan solide dès le premier jour

- Identifiez les outils et systèmes réellement nécessaires à votre agence

- Découvrez comment l’automatisation, la marque et le marketing digital stimulent la croissance

Vous voulez voir comment cabinets et agences d’assurance gagnent des assurés plus facilement ?

Schedule a Demo

Pourquoi l’automatisation marketing est essentielle pour les agences et cabinets d’assurance

Les agences et cabinets d’assurance font face à des défis uniques, de la gestion de grands volumes de données clients au maintien de la compétitivité sur un marché rapide. Voici comment l’automatisation marketing y répond :

Maximiser la rétention et l’acquisition :

Convertissez les leads en assurés grâce à des messages personnalisés et opportuns. Des campagnes drip, rappels de renouvellement et offres ciblées stimulent l’engagement et les renouvellements.

Éliminer les processus manuels :

Automatisez les tâches répétitives (emails, mises à jour de polices, rappels de facturation) pour gagner du temps et réduire la charge administrative.

Communication client personnalisée :

Automatisez l’onboarding, les relances et les rappels de service pour un parcours client fluide et des relations renforcées.

Traitez plus rapidement vos renouvellements :

Générez lettres pré-renouvellement et de renouvellement, enquêtes et documents requis à partir des données AMS/BMS existantes — en supprimant la saisie manuelle.

Prévention des erreurs et omissions :

Protégez votre cabinet en assurant une remise de documents précise et opportune. Gagnez du temps, réduisez les coûts et fluidifiez vos opérations grâce à l’automatisation.

Fonctionnalités intelligentes d’automatisation marketing pour l’assurance :

Chez PathwayPort, nous comprenons les besoins spécifiques des agences et cabinets d’assurance ; nous avons donc conçu une plateforme taillée pour votre activité. Pensée pour des résultats concrets, notre solution complète intègre des outils qui rationalisent les opérations, renforcent l’engagement et stimulent la croissance. Voici comment l’automatisation intelligente peut transformer votre activité :

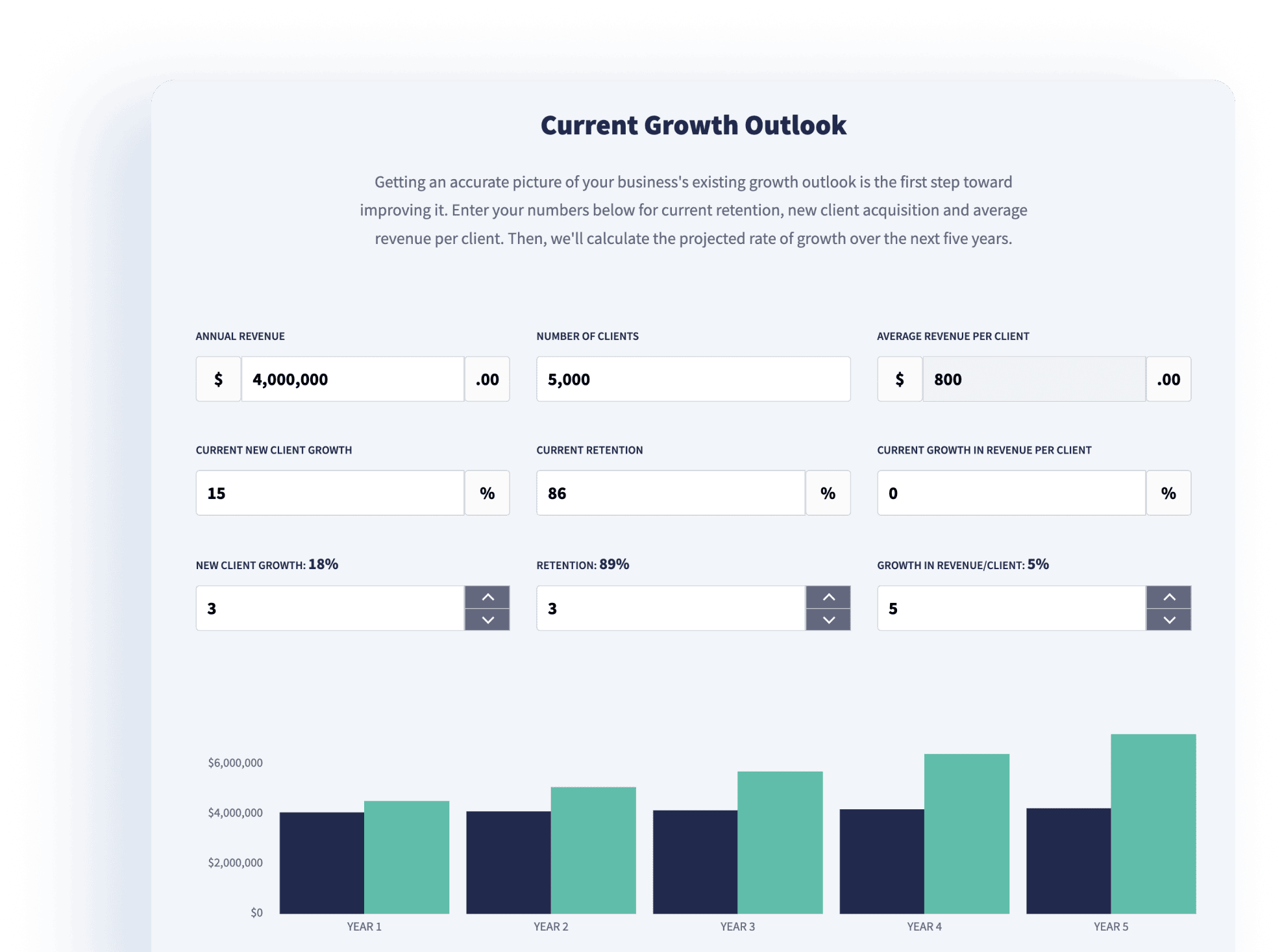

Évaluez votre potentiel de croissance

Curieux de savoir jusqu’où votre agence peut croître avec PathwayPort ? Notre calculateur de croissance simple d’utilisation projette votre potentiel à partir d’indicateurs clés. En saisissant quelques informations de base sur vos opérations, vous visualisez l’impact de l’automatisation marketing et de workflows rationalisés sur vos résultats. Cette projection personnalisée clarifie le ROI potentiel de PathwayPort. Essayez notre calculateur :

Essayer maintenant

Pourquoi les agences et cabinets d’assurance choisissent PathwayPort : workflows, gains de temps et ROI prouvé

PathwayPort propose des solutions d’automatisation de pointe adaptées aux agences du Royaume-Uni, des États-Unis et du Canada. Notre plateforme cloud aide les cabinets à changer d’échelle grâce à :

Interfaces conviviales

Simplicité d’usage pour des équipes de toute taille.

Support dédié

Notre équipe vous accompagne vers la réussite à chaque étape.

Résultats éprouvés

Plébiscité par les professionnels de l’assurance dans le monde.

Expériences client personnalisées

Améliorez la rétention grâce à des communications automatisées et opportunes.

Croissance du revenu

Augmentez l’upsell et le cross-sell sans effort.

Indicateurs de performance

200+

Workflows et expansion

500+

Modèles d’e-mails et articles sur mesure

80%

Moins de tâches manuelles (agences moyennes)

70%

Croissance sur 5 ans

Questions fréquemment posées

PathwayPort propose plusieurs fonctionnalités pour générer davantage de leads, notamment :

- Formulaires de capture de leads automatisés : créez des formulaires personnalisés pour capter des leads depuis votre site et d’autres canaux.

- Intégration avec des plateformes de génération de leads : connectez PathwayPort pour importer automatiquement de nouveaux leads.

- Campagnes marketing ciblées : menez des campagnes pour attirer de nouveaux clients selon la démographie, le type de police et d’autres critères.

Le ROI de l’automatisation marketing est clair : nos clients constatent des améliorations notables sur des axes clés, tels que :

- Rétention accrue des assurés : l’automatisation des rappels personnalisés et des relances réduit les lapses et améliore la fidélisation.

- Taux de conversion plus élevés : des campagnes ciblées et un nurturing automatisé augmentent fortement la conversion en clients.

- Efficacité et gains de temps améliorés : l’automatisation des tâches répétitives libère l’équipe pour des activités à plus forte valeur (relation client, closing).

- Revenus accrus via cross-sell et upsell : des campagnes automatisées permettent de proposer des produits pertinents aux clients existants.